Bond markets

Page views: -

What are bonds?

The name itself suggests something binding, namely an instrument of debt in the form of a tradeable financial asset, or security. The entity issuing bonds (the issuer) obtains financial resources from investors buying the bonds. Just as with a bank loan, the money obtained is owed and must be repaid.

Most commonly, bonds are issued with coupons. In accordance with the terms of the bond issue, the issuer regularly (e.g., one to four times a year) pays interest (the coupon) to bondholders on the money owed until the bond matures. With the final payment, the issuer also repays the money owed (face value). Bonds are usually issued with a maturity of five or more years, the main reason being the comparably high fixed costs that are best spread over a longer period. Another reason lies in the suitability of bonds as instruments for raising finance for projects with a delayed return on investment.

Prospectus or no prospectus?

A bond prospectus is a document with information for investors, intended to assist in assessing the potential risks associated with the bond issue. Given the extent of the information to be included in a prospectus, creating it can be demanding.

Bond without a prospectus

The following situations permit the issuing of bonds without a prospectus:

- Bond issues below specified thresholds may be made available in a public offering if they do not exceed EUR 1m (or an equivalent in Czech koruna) over a period of 12 months. These are typically worth between CZK 10m and CZK 20m, often accessible on innovative trading platforms capable of reducing bond placement costs.

- Bond issues above specified thresholds, i.e., above EUR 1m, without a prospectus may not be sold in a public offering. They may only be offered by means of a private placement to a pre-selected group of investors such as banks, investment funds or insurers, or to no more than 149 natural persons. The law also limits the maximum volume of financial resources to be raised by the sale of bonds to retail investors.

Due to the lower threshold dictated by economic reasons and the upper threshold determined by limits imposed on non-public offerings, these usually involve bond issues raising between CZK 100m and CZK 250m.

Advantages of bond issues without a prospectus

- Reduced demands on time, finance and administration as only the bond issue terms need to be drawn up.

- Less information is released.

Disadvantages of bond issues without a prospectus

- Issuing bonds worth more than EUR 1m without a prospectus is possible through a non-public offering only, limiting the pool of potential investors to certain categories.

- Access only to a reduced volume of funding due to the inability to offer bonds to a broad pool of potential investors.

Placing bonds in a non-public offering is not without its risks in terms of the liquidity secured (i.e., the ability to reach enough investors). Seeking the assistance of suitable financial and legal experts is therefore recommended.

Issuing bonds with a prospectus

Public bond offerings exceeding EUR 1m in value require the issuer to complement the terms of the issue with a prospectus. The prospectus contains information about the terms of the issue, the sale and repayment of the bonds, the financial status of the issuer and the identification of potential risks of failure to repay the bonds issued.

Public bond offering with a prospectus

A public offering involves attracting an unspecified group of investors with an issue of bonds, supplemented by a prospectus providing information on the terms of the issue, the sale and repayment of the bonds. The objective is to enable potential investors to make an informed decision on the purchase, or underwriting, of the debt securities. Selling bonds through a public offering requires the release of a corresponding prospectus and approval for a public offering from the Czech National Bank (CNB). However, this still does not equal public tradeability.

Public tradeability

Public tradeability is the ability to actively sell/buy the securities on existing markets (such as Prague Stock Exchange). Publicly tradeable bonds are more attractive for investors thanks to their higher liquidity. Such bonds, however, must meet additional conditions specified by the market, e.g., the Prague Stock Exchange.

Putting together a bond issue

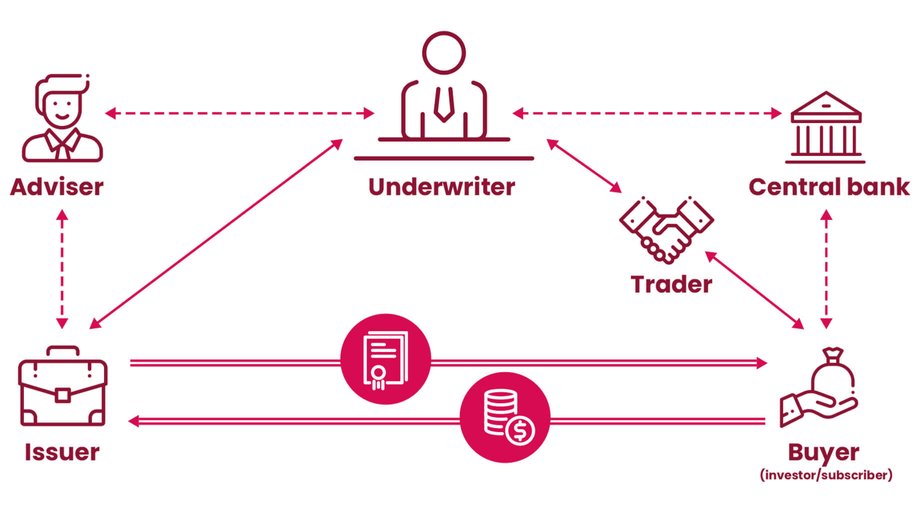

The whole process of issuing bonds is rather demanding. The recommended route is therefore to take advantage of the services of experienced advisers and an underwriter.

- The underwriter (lead counsel or securities trader) is an essential participant in the process of a bond issue as they direct the whole process.

- A legal counsel is often also part of the mix as they assist in drawing up the prospectus and/or the less detailed terms of the issue.

- A bond trader assists in the structuring of the issue and oversees the placement and sale of the bonds.

- For bigger bond issues, making use of additional financial advisers, who can help in structuring the transaction, is also recommended.

The preparatory stage includes an assessment of the issuer’s ability to repay the intended volume of bonds. This assessment also produces a realistic set of issue terms. The terms of the issue are then specified in detail in cooperation with the legal counsel. A prospectus is required for public offerings in excess of EUR 1m and such offerings must be submitted to the CNB for approval.

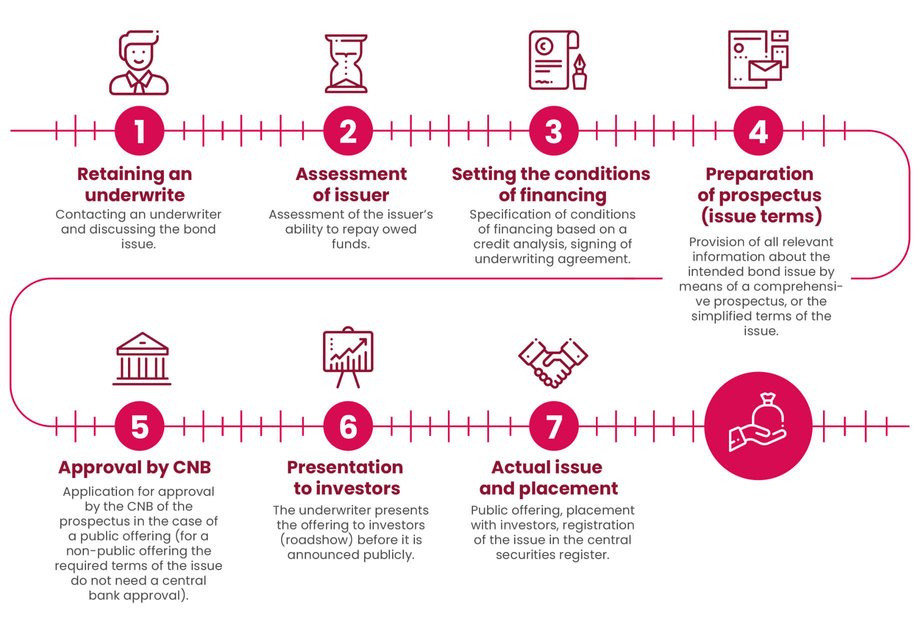

Once all the preliminary steps have been completed, the trader offers the bonds to buyers/investors and the issuer receives the funds, to be repaid at a later date. The whole process comprises the following main steps:

The whole process of a bond issue not requiring a prospectus usually takes five to six months. If the issue requires a prospectus, one or two extra months are usually required.

The cost of a bond issue

- Internal costs of gathering the necessary financial information.

- Underwriting fees for administering the issue are in the region of CZK 500,000 to CZK 700,000 a year.

- The trader takes a commission for placing the bonds of around 3% to 5% of their value.

- Associated legal fees are between approximately CZK 200,000 and CZK 300,000 for an issue with a prospectus, and between CZK 100,000 and 150,000 when a prospectus is not required.

- The underwriter takes a commission of around 3% to 5% of the value of the bonds placed.

- The issuer will also pay a fee of 0.25% to 0.5% a year to the underwriter for managing the issue.

The overall costs of a bond issue vary depending on the size of the issue. As a rule of thumb, bigger issues are more advantageous as the fixed costs remunerated to the underwriter, trader and counsel are diluted in the bigger volume of funding raised.

Examples of cost estimates for different bond issues:

| Cost entry | Issue w/o prospectus | Issue w/o prospectus | Issue with prospectus |

|---|---|---|---|

| Issue size | CZK 100m | CZK 150m | CZK 300m |

| Legal counsel | CZK 100,000 - 150,000 | CZK 100,000 - 150,000 | CZK 200,000 - 300,000 |

| Fixed costs of transaction | CZK 700,000 - 1m | CZK 700,000 - 1m | CZK 700,000 - 1m |

| Variable costs of transaction (3–5%) | CZK 3m – 5m | CZK 4.5m – 7.5m | CZK 6m - 12m |

| Additional counsel (optional) | - | - | - |

| Total one-off costs | CZK 3.8m - 6.15m | CZK 5.3m - 8.65m | CZK 6.9m - 13.3m |

| Total one-off costs as % | 3.80 - 6.15% | 3.50 - 5.77% | 2.30 - 4.43% |

| Annual administration cost | CZK 200,000 - 400,000 | CZK 300,000 - 600,000 | CZK 600,000 - 1.2m |

When bonds fit the bill

Bonds, in a similar fashion to bank loans, serve as an instrument to secure funding for a business in the active stages of its development, beyond inception, when it may still lack reliable revenue and profit required for repayments. Moreover, when weighing the risks and benefits of an investment, responsible investors consider the issuer’s track record in honouring obligations and such information is not readily available in the early stages of a company’s existence.

For bonds, as an alternative to bank loans, it is wise to consider the following aspects:

Bonds are suitable for:

- Raising sizeable volumes of funding from a diverse pool of creditors, combined with a longer debt maturity

- Businesses with reliable and predictable revenue streams coming from an established customer base

- Financing larger projects spread over a longer period (bonds involve relatively high up-front fixed costs and a complicated process for the actual issue, which is why even smaller issues involve hundreds of millions of Czech koruna).

Benefits of bond issues

The advantage of issuing bonds lies in the opportunity to raise a considerable amount of financial resources with a longer debt maturity. Businesses raise capital by issuing bonds to support the growth of their undertaking, acquire real property or equipment, carry out profit-generating projects, fund research and development or hire employees. The main benefit of raising capital via a bond issue lies in the acceleration of growth compared to a business that puts off investment until the necessary capital is created from revenue.

Compared to a bank loan, where the lending bank sets a number of conditions before granting a loan, a standard bond issue offers greater flexibility as it allows the issuer to specify the terms of the issue while also allowing greater freedom in utilising the funds raised. The more lenient conditions of bond issues also preserve access to additional sources of finance, which may be put out of bounds by the conditions attached to a bank loan.

Bonds vs bank loans

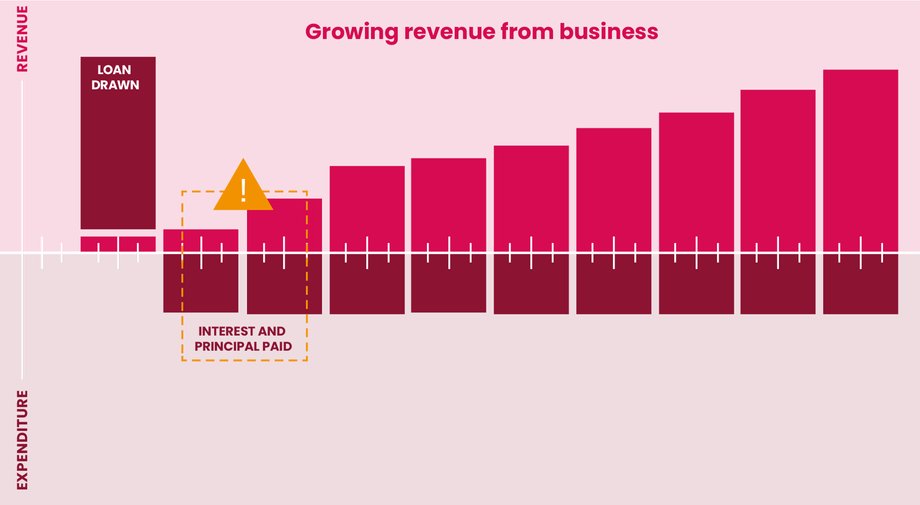

Revenues from business that increase gradually often fail to match the demands of banks regarding the repayment of loans. At the time when repayments begin, a business may still lack available funds for instalments repaying the face value and interest, since the funded project in its early stages does not generate sufficient revenue streams.

Bonds, on the other hand, delay the repayment of the amount owed until a later date, while only the interest is paid. Thus, the repayment of bonds is more closely aligned with the actual progress of a business undertaking, namely limited revenues and low payments in the early stages but higher revenues and the repayment of the debt when the funded project is in place.

Bank loan and business revenue

Bonds and business revenue

Low income at the beginning of the business corresponds to low interest payments and does not burden the company.

Advantages and disadvantages of bonds

- Diversification of creditors, reduced risk of inaccessibility of additional sources of funding

- A period of interest payments only as the owed amount is repaid only upon maturity

- Increased awareness of the issuer during the public offering

- Smaller extent of limiting conditions (covenants) compared to a bank loan

- No transfer of ownership to creditors and associated loss of control over the company compared to equity securities (shares). Bonds are debt securities.

- Publicly tradable bonds improve access to alternative sources of finance.

- Out of reach as source of funding for businesses in early stages of development, compared to equity financing (risk capital).

- Raising capital through a bond issue is more time demanding compared to securing a bank loan.

- Higher initial (entry) costs compared to a bank or private loan.

- Higher interest rates compared to a bank loan.

- Administrative demands.

Types of bonds

There is a wide array of bond types. The most basic classification would divide them into sovereign (government), municipal and corporate bonds. This text concerns itself with corporate bonds. These can be classified according to the interest rate, availability of the asset-based security and other features or terms. The terms of a bond issue are specified by the issuer according to the needs of the issuer and their acceptability to investors.

Secured bonds

In order to strengthen the trust of investors, the issuer may pledge an asset (e.g., property or receivables) as collateral, obtain surety from an affiliated business (e.g., a parent company promising to repay debt for its insolvent subsidiary), or secure the bonds in another fashion (e.g., by pledging to use revenues from the funded project primarily for bond repayment).

This increased trust translates into higher attractiveness of the bonds when placing them on the market and potentially also into a lower interest rate (coupon) that is a cost to the issuer.

Unsecured bonds

If the issuer is unable to pay interest or repay the face value, bondholders are entitled by law only to compensation from the issuer’s assets. There is therefore an increased risk to investors of not recovering their investment in the event of the issuer’s insolvency.

Fixed rate bonds

The interest rate remains the same for the whole term of the bonds.

Variable rate bonds

For bonds with a variable rate, the interest rate changes in alignment with an agreed reference value. The most common approach is to increase the quoted margin (coupon rate/margin) according to a reference interest rate, such as the Prague Inter Bank Offered Rate (PRIBOR). The margin remains fixed, while the reference rate develops over time, causing changes to the interest rate paid on the bonds.

Zero coupon bond

A zero-coupon bond carries no regular interest (coupon) payments during the term of the bond while the face value is due for repayment upon maturity.

Practical example

After a strategic shift, the developer repurchased buildings it previously sold

The developer behind successful Prague business centre Brumlovka made a strategic shift in 2014. It decided to repurchase and manage office buildings the company once successfully sold. Thanks to bond issues, they now again own six out of the nine office buildings in Brumlovka. What is behind a successful bond issue? How does the issuer properly target investors and gain their trust? Watch the story of Passerinvest Group.

Are bonds suitable for your company?

What are bonds and why consider financing a business through them. Tomáš Kálal, Director of the Investment Banking Department at Conseq, answered these questions. In the interview, you will find out who you can issue bonds to, how complicated this process is, how much it costs and what the risks are.

What next, where to turn?

First, it is advisable to select the underwriter (lead counsel or securities trader) to act as the main partner for the bond issue.

- The underwriter accompanies the issuer throughout the whole process, overseeing all required steps.

- In cooperation with a team of lawyers, either in-house or third-party (and possibly other advisers), the underwriter also helps with the preparation of the prospectus (information document).

The trader also helps with structuring the issue, preparing documentation related to the offering and presenting the offering to investors during the roadshow.

| Financial counsel | Legal counsel | Trader (bond issue underwriter) |

|---|---|---|

| Corresponding expertise in capital markets and corporate finance | Law office with expertise in corporate law and financial markets | Corresponding expertise in capital markets, corporate finance, marketing and sales |

| - Coordination of the whole transaction | - Příprava prospektu, včetně jeho schválení ze strany ČNB, popř. vyhotovení jednodušších emisních podmínek. - Asistence s informačními povinnostmi. | - Specification of the essential conditions of the bond issue in order to make the issue attractive to investors - Assisting with investor roadshow and marketing - Seeking out potential investors |

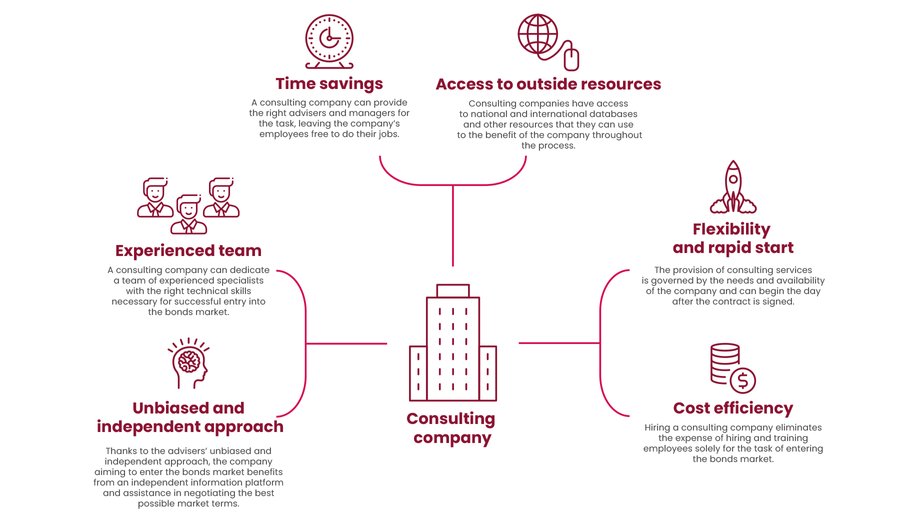

Advantages of retaining a consulting company:

Despite the option of completing the whole process without third-party assistance (consulting company), in reality there are very few companies that have their own capacity for this. The vast majority employ people with bond market experience and it is not financially viable for them to hire additional staff only to manage entry to the bond market. Most companies therefore hire a financial advisor, paid according to their success in dealing with the whole process.

Tips and contacts

How to use the website to obtain financingLegal advisersFinancial advisersLegislation and regulations relevant to the bond market

- The core legislation governing bonds is Act No. 190/2004 of the Czech Legislative Code, on bonds, as amended.

- The core legislation governing commercial companies and cooperatives is Act No. 90/2012 of the Czech Legislative Code, on commercial companies and cooperatives, as amended.

- The core legislation governing the conduct of business on capital markets is Act No. 256/2004 of the Czech Legislative Code, conduct of business on capital markets, as amended.

- The core regulation governing the obligations pertaining to a prospectus describing a securities issue is Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus.

- The relevant legislation and regulations are supplemented by rules applied by the Prague Stock Exchange (BCPP).